15 Actionable Strategies To Increase CPA Exam Pass Rates in 2022

That Will Take 10+ Minutes To Implement And Will Convince All Your Students To Sit For The CPA Exam

- ➫ by Bryan Kesler, CPA

ABOUT THE AUTHOR:

Bryan Kesler, CPA is a CPA Practice Advisor Top 20 Under 40, Licensed Certified Public Accountant, and founder of Kesler CPA Review, Community and Mentorship Platform.

- ✎ Updated

By the end of this article you will be armed with 15 fool proof methods for motivating even the most stubborn accounting students to take the CPA exam and will debunk the most common excuses accounting students make for NOT even trying to sit for the CPA exam.

Why is this important you may ask?

I was recently part of an accounting career fair and I was approached by a 4th year accounting student and she looked me square in the eyes, squinted and asked me to “convince” her why she should take the CPA exam.

As I stood there with my mouth wide open, I was completely speechless and couldn’t believe that I had to explain the vast benefits of why passing the CPA exam is crucial to having a successful accounting career.

Unfortunately statistics are showing this mindset is becoming more prevalent on college campuses:

According to this Journal Of Accountancy article, in the year 2015 only 78% of accounting majors express interest in taking the CPA exam and only 70% are actually sitting for the CPA exam.

Additionally, as stated by the AICPA President, CEO Barry Melancon in his 12/2014 CPA Letter Daily

“We have had about six consecutive years of record numbers of people majoring in accounting. That’s a great thing. For the last three years, however, we’ve basically had a level number of people taking the CPA exam. So there is a gap that’s building.”

This is understandable when you look at the pass rates of the CPA exam for 2016 & 2017:

2017 Pass Rates By CPA Exam Section

| Jan - Feb | Apr - May | July - Aug | Oct - Nov | Cumulative | |

| AUD | 43% | 52% | 52% | 48% | 49% |

| BEC | 50% | 55% | 55% | 55% | 53% |

| FAR | 43% | 44% | 48% | 43% | 44% |

| REG | 46% | 48% | 49% | 46% | 47% |

2016 Pass Rates By CPA Exam Section

| Jan - Feb | Apr - May | July - Aug | Oct - Nov | Cumulative | |

| AUD | 45% | 49% | 45% | 44% | 46% |

| BEC | 55% | 56% | 58% | 53% | 55% |

| FAR | 45% | 46% | 48% | 43% | 46% |

| REG | 48% | 50% | 50% | 46% | 48% |

As influencers in the lives of accounting students every day, it is our responsibility to close this gap and show students how to actually pass the CPA exam and if they are afraid of failure, show them you can overcome it.

It's also important that if they are worried about student loans and other expenses that investing in the right studytools and materials to take the CPA exam are crucial and they are worth the investment.

After having the privilege of working with thousands of CPA candidates across the globe I have discovered 15 proven strategies to motivating and encouraging students to do the right thing and take (and pass) the CPA exam that you can begin implementing today in your class in as little as 5 minutes.

CPA Exam Strategies Table Of Contents

Strategy #1: Incremental Growth Method

Strategy #2: Money Is Not The ONLY Benefit Of The CPA Exam

Strategy #3: CPA Exam Is Too Expensive Response

Strategy #4: Not Smart Enough To Pass The CPA Exam Response

Strategy #5: Learning Man Method

Strategy #6: The Challenge Technique

Strategy #7: Share Your CPA Exam War Stories

Strategy #8: The Life Audit

Strategy #9: Talk It Out & Common Student Excuses

Strategy #10: Man Behind The Curtain Technique

Strategy #11: Why Do We Fall Strategy

Strategy #12: The Busy Season Simulator Method

Strategy #13: CPA Exam Power Up Strategy

Strategy #14: Passion Project Formula

Strategy #15: Alphabet Soup Strategy

Strategy #1:

Incremental Growth Method

![]()

PROBLEM

Students don’t understand how passing the CPA exam will give them immediate results.

SOLUTION

Create an emotional connection with your students by sharing personally how the CPA exam changed your life using the Incremental Growth Method.

ESTIMATED TIME

10 minute class discussion

The most obvious benefit to passing the CPA exam is that CPAs will likely make $1 million dollars more over their career than a Non-CPA.

Unfortunately I have found that this is NOT the best motivation for convincing accounting students to take the CPA exam.

The problem with sharing this data with your students is that to them one million dollars is not immediate benefit.

College students (with mountains of student loan debt) need to see short term benefits in order to motivate them to take the CPA exam as soon as possible.

This is why the Incremental Growth Method is one my most effective motivational tactics.

What I love about this method is that it immediately puts the results that can be obtained from passing the CPA exam and working in public accounting into perspective.

Step By Step Example of Incremental Growth Method:

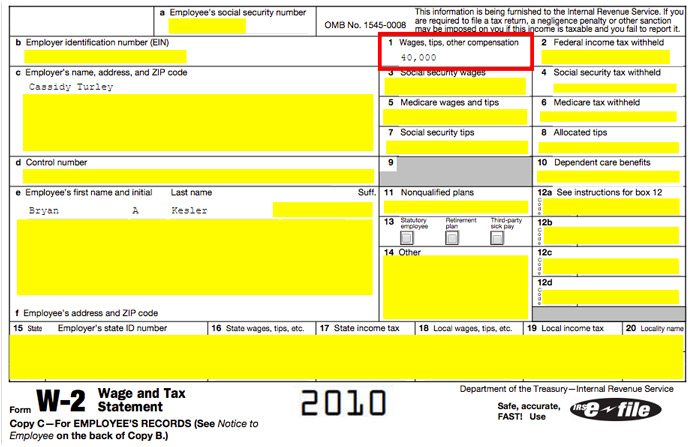

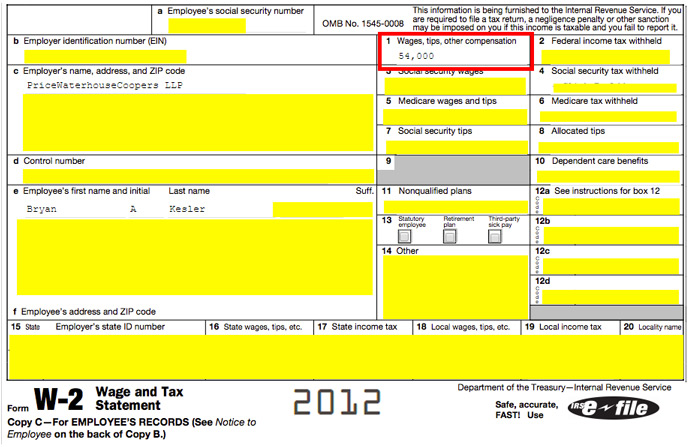

Instead of telling my readers that if they pass the CPA exam they will likely make $1 million more over their career than a non-CPA, I shared my annual salary information as a non-CPA and the results I had after I passed the CPA exam.

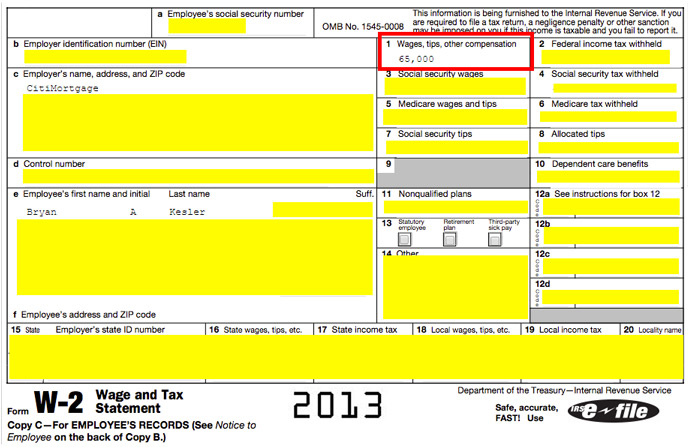

1) My Pre-CPA salary = $40K/yr as a client accountant

2) My Salary after 2 months of passing the CPA exam = $54K/yr as a PwC Experienced Auditor

3) My Salary at end of Year 2 of being a CPA = $65K/yr as an Assistant VP of Financial Reporting at CitiMortgage

By providing my readers with real scans of my W-2’s (with personal info blacked out of course!) it shows them my real results and the type of positions I held and how I obtained them.

By doing this I create an emotional connection with my readers who may be on the fence about whether they should take the CPA exam or not.

To most college students, $1 million dollars isn’t a real number that they can comprehend, but $25K is a number that they immediately can connect with emotionally based on the fact that student loans, mortgages and weddings etc… are on the horizon.

What You Can Do

Here is the step by step system that you can use to implement the Incremental Growth Method in your classroom:

Step #1: Real Results

Show real results of what happened to a specific person after passing the CPA exam, avoid vague benefits. Be specific and use real life examples if possible.

Step #2: Emotional Connection

Ensure there is an emotional connection between the student and the results that you show.

Step #3: The Big Reveal

Reveal how passing the CPA exam can skyrocket their career and salary via promotions, jumping positions or even career paths.

As teachers/professors you all have unique stories and backgrounds.

I highly recommend looking back at what happened to your career after you passed the CPA exam or feel free to use my case study!

Link: https://www.cpaexamguide.com/cpa-exam-worth-it

Strategy #2:

Intangible CPA Exam Benefits Technique

![]()

PROBLEM

Students don’t know any benefits for becoming a CPA other than making more money.

SOLUTION

Share these 4 additional benefits to passing the CPA exam that (I believe) outweigh the benefit of making more money.

ESTIMATED TIME

10-15 minute class discussion

As mentioned in Strategy #1, the key to creating urgency for your accounting students to take the CPA exam is to reveal the short term benefits of becoming a CPA.

This is why it is so crucial to explain that there are more benefits to passing the CPA exam than just making a lot of money.

There are 4 other intangible benefits that I share with all of my students that helps put perspective into WHY passing the CPA exam is so important for their careers long term success.

Benefit #1: Job security

As someone who lost his first job due to the economy in April of 2009 and the fact that I hadn’t passed the CPA exam, job security was my #1 concern.

Obtaining your CPA exam is the absolute best way to ensure that you retain your job when cuts have to be made can be a very motivating factor when a student is considering taking the CPA exam or not.

Benefit #2: Professional Recognition

Be sure to explain to your students that as a CPA you are held to a higher standard, but being a CPA is also like being in an exclusive club.

Almost every industry understands that the CPA exam license is an elite certification. They know without even meeting the individual that as a CPA he/she would be an extremely motivated and determined individual.

Benefit #3: Career Development

Remind students that if they want to fast track their career that the CPA exam is a crucial key to this puzzle.

As more and more professionals are getting their MBA or Masters, it is becoming more difficult to stand out in the crowd.

Obtaining a CPA license is like a golden ticket to getting a promotion or finding a better job elsewhere.

Benefit #4: Career Flexibility

Career flexibility is one of my favorite benefits of the becoming a CPA.

I have friends who went from public accounting to the FBI, to teaching, and working for start-ups all because they passed the CPA exam and used it as a tool to get where he/she wanted to go.

Always remind students that in 10+ years accounting may no longer be interesting or challenging to them, and without the CPA license it is much more difficult to jump career paths.

Strategy #3:

CPA Exam Is Too Expensive

![]()

PROBLEM

Some students make the common excuse that they can’t afford to sit for the CPA exam.

SOLUTION

Show your students that the CPA exam is not an expense, but a long term investment that will reap dividends for their entire career.

ESTIMATED TIME

10 minute one on one or class discussion

With student loans being the focal point of this presidential election, the cost of education is on the minds of today’s accounting students.

The fact that the CPA exam itself costs close to $1,000 and a quality CPA review course will cost between $1,000-$3,300, it doesn’t leave a lot of breathing room for many student’s bank accounts.

However this is a dangerous misconception that I find myself dealing with on almost a daily basis.

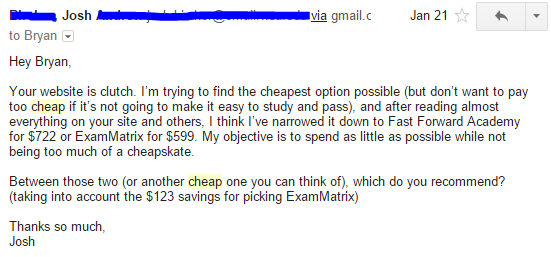

Example Email:

Emails like this make me cringe…

Students who try to cheap out on CPA exam materials will often fail because they don’t have all the tools they need to pass.

When candidates "cheap out" on a CPA review course that doesn't give them enough to pass the CPA exam, they end up spending more money overall with additional CPA exam fees for re-taking sections of the exam.

Remind your budget minded students that the CPA exam will pay dividends for the rest of their career.

The idea of not spending $2K-$3K on the CPA exam now will actually cost them tens of thousands of dollars every year in lost income potential if they fail to sit for the CPA exam immediately after college.

Please don’t let your students fall into this trap.

Strategy #4:

Not Smart Enough To Pass The CPA Exam

![]()

PROBLEM

Some students are convinced they aren’t smart enough to pass the CPA exam and use that as an excuse to not even TRY to take the CPA exam.

SOLUTION

Remind them that the CPA exam is NOT an IQ exam, but requires taking it one day at a time.

ESTIMATED TIME

5-10 minute class discussion

The CPA exam is the most overwhelming exam that any accounting student will encounter.

I have seen students with 4.0 GPAs who are presidents of Beta Alpha Psi fail the CPA exam multiple times and give up, and I have seen average students with sub 3.0 GPAs pass the CPA exam on their first try.

The CPA exam is not so much how SMART you are or your GPA, but has everything to do with how mentally prepared you are and what you are willing to sacrifice in order to pass.

Remind your students that if they are able to graduate and complete the education requirements to sit for the CPA exam then they are able to pass the CPA exam with the proper motivation.

A great way to break the ice would be to ask your class out right to raise their hands if any of them don't plan on taking the CPA exam and then ask them why.

Strategy #5:

Learning Man Method

![]()

PROBLEM

Students don’t take the time to understand how they learn and instead create busy work for themselves.

SOLUTION

Use the Learning Man Method to help them identify how they learn best which will help them save time and money when it comes time to sit for the CPA exam.

ESTIMATED TIME

1-4 hours for students to test on their own

The majority of students fail the CPA exam because they don’t know how they learn best and end up creating busy work for themselves instead of efficient studying.

This is why I use the Learning Man Method almost every day to help CPA Candidates eliminate ineffective study habits and focus only on what works.

This is crucial to your student’s success because CPA review courses only provide what the CPA candidate needs to know for the exam not how to actually study and retain the information.

Due to the fact that everyone learns differently the best place to start identifying learning strengths and weaknesses is during accounting classes.

There are 3 questions to ask in the Learning Man Method which I use to help CPA candidates all over the world determine how they learn best.

Have students take out a piece of paper and answer the following:

Question #1:

Do you gain a better understanding of accounting topics in class listening to lectures (visual/auditory learner) or on your own via reading the text or completing questions (self-studier)?

NOTE: Explain that this is important to know when determining whether to use a live CPA review course or self-study

Question #2:

Do you create your own flashcards/outlines by hand?

If yes, what % of time studying do you spend creating these resources? Do the benefits received from creating these resources outweigh the time spent?

If no, why not, are you able to quickly memorize definitions using your current method?

Challenge: Using trial and error see what the most effective AND efficient method of memorizing definitions is.

Question #3:

Do you constantly review your accounting materials throughout the semester? Or do you wait until the end and cram?

- If you constantly review everything you have learned do you find that it is easier to study and actually recall what you have learned throughout the semester? How much time do you spend reviewing every week?

- If you are someone who crams do you find that you forget everything that you have learned at the beginning of the semester by the time you get to final exams? I challenge you to spend just 15 minutes a week reviewing everything you have covered since the beginning of the semester.

By asking students these questions they will hopefully take a step back and look at how their study habits are affecting their grades, time and overall understanding of their courses.

Understanding How Each Student Learns Will Make It Easier To Identify Which CPA Review Course To Use

If you can encourage them to experiment now to truly figure out what works best for them it will make passing the CPA exam easier, less time-consuming, and best of all more affordable (less CPA exam fees and less spent on CPA review course materials).

They will also be able to easily identify which CPA review course is going to work best for them based on how they learn.

If you know of any students currently researching CPA review courses that will match with how they learn best, this is the best place to start:

LINK: Compare Top 10 Best CPA Review Courses

Strategy #6:

The Challenge Technique

![]()

PROBLEM

Students don’t like to get bored, which will likely happen to them if they don’t become a CPA.

SOLUTION

Use my 4 step Challenge Technique to reveal the types of jobs that are available to CPAs and Non-CPAs and explain the differences.

ESTIMATED TIME

15-30 Minute Class Discussion

I find the Challenge Technique to be effective for students who get bored easily.

Students who end up bypassing the CPA exam and public accounting and go into private industry quickly find that the available accounting jobs become quite monotonous and leaves the student feeling unfulfilled.

This can be an amazing motivator for most young professionals looking to find a way out of an accounting position that has turned into drudgery.

This happened to me personally. During the economic crisis of 2008-2009 I was able to find a basic accounting job after my public accounting firm let me go. As a bookkeeper I found myself doing the same duties month after month and within a year I had mastered my position and got bored.

I used this boredom as motivation to pass the CPA exam because I knew I was meant to do more with my accounting career than just make the same journal entries every month.

Thankfully I was able to pass the CPA exam and within a month get hired by PwC as an experienced auditor and I was once again challenged by my job!

Unfortunately in college it is hard to create the same kind of motivation.

The best way I have found to help accounting students understand this fact is to explain to them in college exactly what kind of jobs will be available if they choose to skip the CPA exam and Public Accounting (and how little they pay!).

Here is the step by step Challenger Technique worksheet that I use:

Step #1: Determine Your Students Career Goals

Have student/professional write a list of goals for what they want out of their accounting career and how they will use their degree to obtain it.

NOTE: Be specific – salary range, how much do they want to be challenged, do they want a management role?

Step #2: Provide list of jobs that don't require masters or CPA license

Provide this list of typical jobs that non-CPAs can obtain in the private industry to your students:

A/P Clerk

Data entry position, cut checks and file invoices, typically hourly pay

($13-16/hr or $23K-$41K/yr)

A/R Clerk

Process deposits from customers, work with customers to obtain payments, typically hourly pay

($13-16/hr or $23K-$41K/yr)

Payroll Clerk

Process monthly payroll, managing hours clocked and payroll data, and creating distributing payroll checks

($24K-$44K/yr)

General Accountant/Book Keeper

Salaried position, preparing monthly journals and closing books monthly.

($22K-$55K/yr)

Fixed Asset Accountant

Manage fixed asset depreciation, adding and removing of assets

($45K-$50K/yr.) - SOURCE

Cost Accountant

Provide management with appropriate costing information, monitor process constraints, target costing projects, margin analysis and tracing costs back to underlying activities. - SOURCE

($45K-$70K/yr.)

Tax Accountant

Prepare and file company tax returns (personal, corporate or government clients) also responsible for reducing tax liability and keeping up with latest regulations.

($51K-70K/yr salary)

Treasury Analyst

Handle company cash accounts, prepare monthly recs and company cash flow

($52K/yr entry level on average; earn as high as $90K/yr with experience)

Government Accountant

Use of fund accounting to focus on financial affairs of governmental organizations

($59K/yr on average)

Assistant Controller

Assist the controller in performing company accounting functions

($80K/yr avg salary)

Key Takeaway

The key takeaway is that without public accounting or your CPA license, these are entry level positions that will take 5-8 years to turn into management level positions. Typically they are also only moderately paying jobs that typically max out at $55K-$70K/yr. or less and involve performing the same duties on a monthly, quarterly and yearly basis.

Students should expect to master any of these positions within 3-5 years and max out on added responsibilities fairly quickly if they are unable to make manager.

SOURCE: http://www.accounting-degree.org/top-paying-accounting-jobs/

Step #3: Provide list of jobs that require public accounting experience and recommend a CPA license

Show them the benefit of having public accounting experience and a CPA license by showing them the jobs and salary levels that can be obtained after 2-8 years of public accounting experience and/or becoming a licensed CPA.

Here the list of popular positions that I use as part of The Challenger Technique:

1) Cost Accountant Manager

Manage all cost accounting activities and oversees the cost control systems, oversees cost audits, and prepares any cost accounting reports for upper management.

($96K/yr average salary)

2) Senior Financial Analyst

Review the company finances and make recommendations to senior management and manage team of financial analysts.

($74K/yr average salary)

3) Risk and Compliance Officer

Designs and implements the policies that ensure the company is in compliance with local, state and federal regulatory requirements.

($99K/yr average salary)

4) PHD Candidate/Professor

After obtaining your masters in accounting you can enter a PHD program, but it helps to get public accounting experience and your CPA first.

Starting Accounting Professor salaries average $127K/yr.

5) Corporate Controller

Oversees all accounting aspects of the company including taxes, budget spend, and accounting department

($112K average salary)

6) Finance Director

Oversees all financial functions including accounting, budget, credit, insurance, tax and treasury

($101K/yr average salary)

7) Chief Financial Officer (CFO)

The top accounting executive of the company overseeing all levels of management, setting long-term financial goals and budgets, and being held accountable for the accuracy, timeliness and legal and regulatory compliance of all financial reporting of the company.

(Average salary is $173K but is generally much higher the bigger the company)

8) FBI Agent specializing in Accounting

Investigate corporate and business crimes (IE fraud and embezzlement). You can also work in the administrative side dealing with FBI budgets and accounting matters.

Salary Range = GS-10 - $47K up to GS-14 - $85K and higher for management positions

9) Forensic Accountant

Identify weaknesses in accounting systems / fraudulent activities, requires extensive knowledge of company

($73K/yr. average salary)

10)

Senior Financial Analyst

Provide senior management with monthly, quarterly and yearly financials and manage lower level financial analysts.

($74K/yr average salary)

11) Information Technology Accountants

Need skills in both accounting and computer systems to assist in maintaining the accuracy and completeness of the companies accounting systems.

(Average salary: $103K)

SOURCE: http://www.accounting-degree.org/top-paying-accounting-jobs/

Step #4: Devote time for students to research these jobs and create list of jobs that fit their career goals

Encourage the student to research these jobs and find a job(s) that they think will be a good fit for them based on what they wrote down in step #1.

The goal being for them to connect the dots that if they are truly passionate about accounting then they are going to need public accounting experience and their CPA license in order to achieve them quickly. Or else they will risk getting into a position that quickly becomes boring and takes years to evolve into what they want to achieve.

Strategy #7:

Share Your CPA Exam War Stories

ESTIMATED TIME

5-10 minutes class discussion or one on one

Along the lines of the Incremental Growth Method, I strongly encourage you to share your personal stories of taking and passing the CPA Exam.

If you are like me, the feeling of passing the CPA exam is on almost the same level of getting married or holding your baby for the 1st time!

I remember exactly where I was, who I hugged, and who I high fived the instant I clicked refresh on NASBA’s website and saw my passing score.

You need to create the same imagery in your student’s minds and convince them that the pain and toil is worth it!

Strategy #8:

The Life Audit

![]()

PROBLEM

Students don’t understand how much they will have to sacrifice in order to pass the CPA exam.

SOLUTION

Instruct them to prioritize their life by listing what is more important than becoming a CPA and what is less important

ESTIMATED TIME

15 minute class project

No one likes giving up activities that he/she enjoys doing.

Unfortunately this is the reality of taking the CPA exam. Students need to be aware that for 6-9 months they will not be able to live a normal life. and t

Tough decisions will need to be made on where and how to spend their time.

The best solution I have found in assisting students and CPA candidates make these tough choices is to have them literally audit their life.

List out all of their hobbies, time wasters, work schedule, social activities, social media, TV shows, video games, planned vacations, family time, and finally the CPA exam.

Once they have written down everything they can think of, have them organize their list based on importance compared to the CPA exam.

If the activity is less important to them than passing the CPA exam then they need to cut it from their life temporarily (or only partake in the activity as a reward for accomplishing a CPA exam study goal).

Here is the 3 step process for having your students complete their life audit:

Step #1: The Life Audit

Have your students list out all of their hobbies, time wasters, work schedule, social activities, TV shows, video games, planned vacations, family time, and finally the CPA exam.

Next, have them prioritize their list and determine which activities in their life are more important than becoming a CPA vs not as important. Rank them in numerical order.

Step #2: Create Plan To Make Necessary Sacrifices

Now that they have prioritized their life, the next step is to determine what they will be sacrificing when they begin studying for the CPA exam and how they will use the priorities above the CPA exam as incentives to complete studying.

Example: If cable TV is a huge time waster, cancel your cable bill.

Example 2: If your family is the #1 priority, set a study goal to complete by a specific day and if you complete it go out and do something fun with your family etc…

Step #3: Have them answer the following two questions

Question #1: What will you sacrifice in order to make time to study for the CPA exam?

Question #2: What will you use as incentives to make time to study for the CPA exam?

After completing these steps, your students will begin to understand that it is easy to compartmentalize their lives based on priority.

By visually seeing what is important to them and not important, it will make finding time to study much easier and the ability to make a routine will hopefully naturally occur.

Strategy #9:

Talk It Out

![]()

PROBLEM

Students hear rumors of how terrible the CPA exam process is and let it psyche them out of ever even trying.

SOLUTION

Open dialogue, honesty and benefits

ESTIMATED TIME

10-20 minutes one on one or class discussion

With social media, Google and forums such as Another71.com or Reddit, students have unlimited resources to research the CPA exam.

Unfortunately there is so much negativity about the CPA exam process that it may scare students away from even trying to take the CPA exam.

By maintaining a positive atmosphere in the classroom and having an open and honest dialogue with students about the CPA exam process will help any student who is doubting the idea of sitting for the exam.

The most common reasons I hear from students for not sitting for the CPA exam and my typical responses are:

Common Excuses |

My Response |

1) Don’t have time to study |

Everyone has the time to study for the CPA exam, it’s just a matter of what you are willing to sacrifice (refer to #8 The Life Audit). They may also be worried about studying for the CPA exam while working full time. Feel free to share with them these 17 study tactics to implement while working full time. |

2) Costs too much to take the CPA exam |

The CPA exam is not an expense. It is an investment in your future that will pay dividends for the rest of your career (refer to #3 CPA Exam Is Too Expensive) |

3) I am not smart enough |

The CPA exam is NOT an IQ exam. If you have completed the education requirements to sit for the CPA exam, you are capable of passing. (refer to #4 Not Smart Enough To Pass The CPA Exam Response) |

4) I have ADHD and can’t possibly focus for long enough to study and pass the CPA exam |

As long as you understand how you actually learn best then you can pass the CPA exam. CPA Review courses like UWorld Roger CPA Review and Wiley CPAexcel are designed to help you stay focused by breaking up long lectures in bite sized chunks so that you are constantly moving between watching, reading and taking quizzes. (Refer to the #5 Learning Man Method) |

Strategy #10:

Man Behind The Curtain Technique

![]()

PROBLEM

Students don’t understand what hiring managers are looking for on a resume.

SOLUTION

Help students understand what HR looks for when hiring new employees out of college AND more importantly how hiring works after being in the job market for several years

ESTIMATED TIME

15-20 minute presentation, include career services

As someone who recruited on campuses for PwC and BKD for 3 years and has worked for several different companies, I know exactly what HR is looking for when it comes to finding potential interns/1st year associates and experienced professionals.

This is also why I believe that the Man Behind The Curtain Technique is so crucial to motivating students to take the CPA exam!

You need to reveal to your students that Accounting Hiring Managers care about 3 core items on a resume:

1) GPA

2) Sufficient experience

3) Do you have your CPA

Remind students that if they match all 3 of these requirements, they will almost be guaranteed to make the cut for an office interview.

Without a CPA license it makes it difficult to obtain the experience they need and if their GPA is lacking the CPA is a perfect way to make up for it.

Strategy #11:

Why Do We Fall Strategy

![]()

PROBLEM

Fear of failure is preventing students from even taking the CPA Exam.

SOLUTION

Show students that failure is okay and actually part of the design of the CPA exam!

ESTIMATED TIME

10-15 minute student project

Accounting students have a stereotype that includes being driven over-achievers, super book smart and most of all students who never fail!

Unfortunately 80% of CPA candidates fail at least one section of the CPA exam and it’s this reality, this fear of failure, which causes accounting students to delay even sitting for the CPA exam.

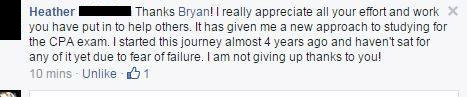

Take Heather for example:

By using what I call my “Why Do We Fall Strategy” I was able to help her overcome her fear of failing!

I developed this strategy because I failed all 4 sections of the CPA exam in a row… and I was CRUSHED.

I was literally inches from giving up on the CPA exam because of how much I HATED failing. Thankfully I lost my first job due to the economy and it knocked some real world sense into me.

I focused on becoming mentally determined to pass the CPA exam so that I could get my career back on track.

It was during these dark hours that I unwittingly created the “Why Do We Fall Strategy.”

I was sitting in my apartment asking myself:

How did I go from a student with a 3.6 overall GPA with a full time audit position lined up before I even graduated to being someone with barely enough money in my bank account to pay rent?

It was at this point that I took out a sheet of paper and wrote out 3 reason I wanted to become a CPA:

Reason #1

I want to be a CPA to be able to provide for my future family.

Reason #2

I want to be a CPA so that I can show employers that I do not give up and that I am willing to dedicate my life to completing a task, no matter how impossible it feels.

Reason #3

I want to be a CPA so that I don't get stuck in a dead end job and be bored out of my mind!

And three goals I couldn’t accomplish in my career without passing the CPA exam:

Goal #1

Job security

Goal #2

Fast track to manager/VP

Goal #3

Start my own company

I kept this sheet of paper in front of me whenever I was studying as a constant reminder why it was worth failing over and over until I passed and the end result was passing 2 sections back to back and finding a job within 2 months.

I strongly urge you to start asking your students to start thinking about WHY they want to become a CPA and what they CAN’T accomplish without passing the CPA exam.

This sheet of paper is going to get them mentally prepared to take the CPA exam and it will (hopefully) erase the fear of failure that might be holding them back.

Student Worksheet

3 Reason I Want To Become A CPA

1)

2)

3)

What Goals I Can’t Accomplish Without A CPA License

1)

2)

3)

NOTE: Keep this sheet of paper in front of you whenever you are studying as a constant reminder!

Strategy #12:

The Busy Season Simulator Method

![]()

PROBLEM

Students don’t understand why the CPA exam is designed the way it is.

SOLUTION

Help students understand the thought process behind how the AICPA crafts the CPA exam.

ESTIMATED TIME

20-30 minute class presentation

As you already know, it isn't in the AICPA's best interest for 100% of CPA candidates to pass the CPA exam.

The CPA exam is designed to be difficult as a way of weeding out the folks who are not passionate/dedicated enough to being the best accountant possible.

Since we are on the front-lines with students it is our responsibility to get them prepared for the CPA exam, which is why I use “The Busy Season Simulator” to help students prepare for what lies ahead.

How to share “The Busy Season Simulator” in 5 steps

Step #1

Don’t sugar coat the facts, explain to your students that only 20% of CPA candidates pass the CPA exam without failing a single section. In fact failure is part of the design of the exam.

Step #2

Reveal the reason for such a low pass rate is the AICPA wants the pool of CPAs to be the most dedicated and motivated accountants. If everyone passed the CPA exam then it would lose its prestige. Remember if everyone is a winner than no one is a winner.

Step #3

Remind your students that even the design of the CPA exam is to mirror the intensity of busy season. Public accounting firms understand that if you can handle the intensity of passing the CPA exam then you will have the mental fortitude to succeed during busy season.

Step #4

Now share the good news that the CPA exam is NOT an IQ exam. It doesn’t test anything that you haven’t already covered in college, so if you can graduate you can pass the CPA exam no matter what your GPA. Do NOT think that because you failed a section of the CPA exam you are not intelligent, that is NOT true!

Step #5

Explain that the CPA exam is all about being mentally prepared (refer to the Why Do We Fall Strategy), having a study system based on routine (refer to Power Up Strategy), and being willing to make the necessary sacrifices in order to make time to study (refer to The Life Audit). Without having an understanding of these concepts your students' odds of passing the CPA exam will drop drastically.

Your Goal Using the Busy Season Simulator Method

These 5 steps will help you be up front and honest with your students.

The goal is not to scare them but to help get them mentally prepared for what is coming next, and hopefully alleviate some of the fears they have about taking the CPA exam.

Strategy #13:

CPA Exam Power Up Strategy

![]()

PROBLEM

Students treat the CPA Exam like a normal college exam.

SOLUTION

Teach students the right way to study for the CPA Exam that actually works and helps them avoid trial and error.

ESTIMATED TIME

25-30 minute class presentation

A common misconception that I see brand new CPA candidates make is that they think they can study for the CPA exam exactly the same way as a college exam.

Examples:

1) Go to class all semester and then cram in the last couple weeks before the final exam, or

2) Make copious handwritten notes, flashcards or other time consuming manual study methods, or

3) My personal favorite, studying just to pass the exam and NOT to actually gain an understanding of the material.

Unfortunately, these examples are the reason for a HUGE % of candidates failing!

This is why teaching the “CPA Exam Power Up Strategy” is crucial to your students success:

Step #1:

Help students understand that the only way to pass the CPA exam is to truly UNDERSTAND the core concepts their CPA review course teaches them as opposed to just doing the same multiple choice questions over and over and memorizing the answers.

Step #2:

Explain that the CPA exam is all about maximizing their short term memory. They will need to cram the equivalent of a semesters worth of studying into 8-12 weeks. More on this in step #3.

Step #3:

In order to maximize their short term memory, students will need to be constantly learning and constantly reviewing. By doing this they will be able to get through massive amounts of material and still keep the information in chapter 1 as fresh as the final chapter. The goal being that as the information taught by the CPA review course builds on each other, the student will gain a better understanding of the material.

Step #4:

Share the importance of making time to study and creating a routine no matter what their work/school schedule.

EXAMPLES: Study for 15 minutes before work, 30 minutes during lunch, listen to MP3 audio lectures on your commute, work out, eat dinner, and study until 10 pm, do something you enjoy for 30 minutes, and go to bed and repeat.

Step #5:

Before sitting for each exam, explain the importance of having a final review in the 8-14 days prior to each exam. This is a period where they stop trying to learn new material and focus 100% on review and strengthening their weakest areas.

Results I Have Gotten With CPA Exam Power Up Strategy

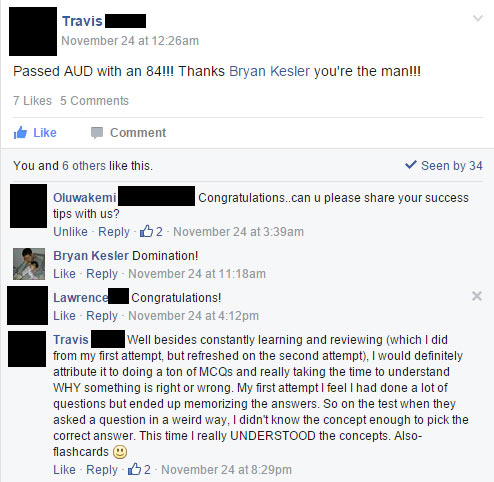

Here is an example of one of my star students that my CPA Exam Power Up Strategy to successfully pass AUD.

Travis has proven that by following these steps even someone with a sub-3.0 GPA can pass the CPA exam.

How To Get These Results With Your Students

If your students have a head start on how to actually study for the CPA exam before they even sit, it will exponentially increase their odds of passing the CPA exam on their first try.

I put together a free CPA exam coaching course that will deep dive into specifics of the 5 steps above that your students should start implementing

right away.

Feel free to share www.ultimateCPAexamguide.com with them

Strategy #14:

Passion Project Formula

![]()

PROBLEM

Students pick accounting as a major, but aren't sure how to be passionate about accounting other than the fact that they can make good money.

SOLUTION

Find something that your students are passionate about and help them realize how accounting and the CPA exam is going to help them achieve this passion.

ESTIMATED TIME

15 minute project and class discussion

Do you have students who picked accounting as their major but aren't sure why?

I have found many students pick accounting as their major because they hear it is a safe career and that they can make good money.

Unfortunately picking a safe career can mean that you are not passionate about your career.

This is why I developed the Passion Project Formula.

If you are going to persuade your students to take the CPA exam then you MUST help them identify what they are passionate about and how accounting/the CPA exam is going to help them achieve this passion.

Once they connect the two then they will be willing to put in the necessary time and effort to pass the CPA exam.

Here is the simple 3 step formula to helping your students identify their passion project and how accounting is going to help them achieve this goal:

Step #1: Identify Passion Project

Help them determine passion by asking “If he/she had a million dollars to put into a passion project (starting a business, a cause, a hobby) what would that be.”

Step #2: Big Picture Question

How is accounting going to help them accomplish their passion project?

Step #3: Push The CPA Exam

How much quicker would becoming a CPA help them achieve this goal?

Help the student identify obstacles in achieving their passion project and how becoming a CPA and the experience that would come with it will assist them in achieving their goals.

Passion In Accounting

The ultimate goal of the passion project formula is to increase your student’s motivation and help them become passionate about accounting.

Once they have connected the dots between their passion and accounting they will be much more likely to take the CPA exam and gain the experience they need to accomplish their goals.

Strategy #15:

Alphabet Soup Strategy

![]()

PROBLEM

With growing competition, students who decide not to pursue the CPA will have difficulty specializing without obtaining some form of professional certification.

SOLUTION

Teach students that employees with letters after their name are more sought after and that there are certifications for every type of specialization in accounting.

ESTIMATED TIME

15-30 minutes one on one

If all else fails remind them that the CPA exam is not for everyone, but that there are other options.

As an accountant, learning and improving of oneself doesn’t end after college.

There are several other relevant certifications that make sense to pursue when the CPA exam isn’t an option:

Other Top Tier Certification

Certified Managerial Accounting (CMA) Exam: If public accounting doesn’t interest a student, remind them that the CMA exam is for anyone looking to get into the private industry. It focuses on the financial analysis and budgeting side of accounting. -

SOURCE

Specialized Certifications

Enrolled Agent (EA) Exam: For any tax majors the enrolled agent exam is an excellent option for anyone looking to specialize is tax preparation.

- SOURCE

Certified Internal Auditor (CIA) Exam: If a student chooses internal audit as a career path, the CIA exam is perfect for solidifying their specialization. - SOURCE

Certified Information Systems Auditor (CISA) Exam: IT Audit and Information Systems are growing fields and the CISA exam is the perfect complement to any student pursuing this career path. -

SOURCE

Certified Fraud Examiner (CFE) Exam: For anyone interested in joining the FBI or becoming a forensic auditor the CFE is the go to certification. -

SOURCE

Certified Bank Auditor (CBA) Exam: The demand for auditors in the financial industry has risen with the increased scrutiny of Wall Street and banking regulations. For any students looking to get a leg up in the banking industry the CBA exam is a perfect way to specialize. -

SOURCE

Certified Government Auditing Professional (CGAP): To help make a difference in reducing waste in government the CGAP is an excellent certification to help accomplish this goal.

Other Certifications That Are Available

Certified Payroll Professional (CPP) and Fundamental Payroll Certificate (FPC)

Accredited Business Accountant

Accredited Financial Examiner (AFE)

Accredited Tax Advisor (ATA)

Accredited Tax Preparer (ATP)

Certified Bookkeeper (CB)

Certified Financial Services Auditor (CFSA)

Certified Forensic Accountant (Cr.FA)

Certified Professional Environmental Auditor (CPEA)

Certified Quality Auditor (CQA)

Forensic Certified Public Accountant (FCPA)

End Goal

If the CPA exam isn't something that a student wants then they should identify a specialization in accounting. Thankfully there are certifications available for any accounting specialization.

Now It's Your Turn

If you know any other professors who are looking to motivate their students to take the CPA exam feel free to share this article with them!